Tax autumn at the University of Belgrade Faculty of Law 2nd lecture

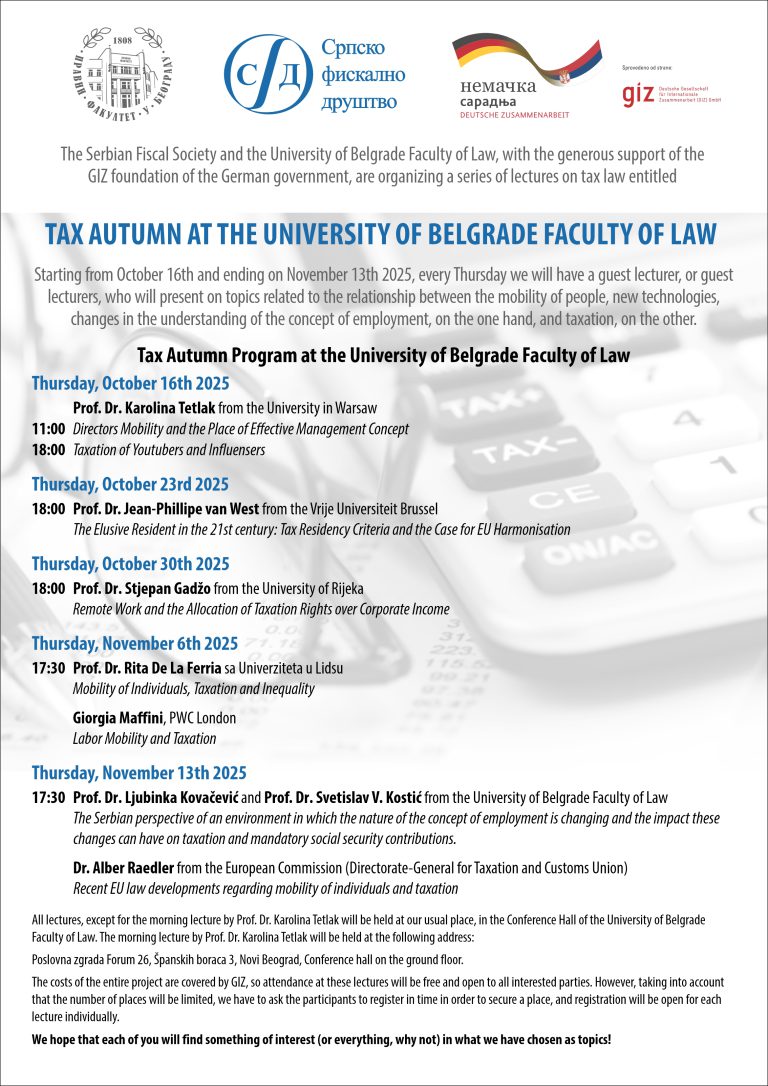

The Serbian Fiscal Society in cooperation with the University of Belgrade Faculty of Law and with the support of the Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH under our joint initiative

Tax autumn at the University of Belgrade Faculty of Law

HAVE THE PLEASURE TO INVITE YOU TO THE THIRD IN A SET OF LECTURES

Prof. Dr. Jean-Philippe van West from the Vrije Universiteit Brussel

Thursday 23rd October 2025

The Elusive Resident in the 21st century: Tax Residency Criteria and the Case for EU Harmonisation

18:00 Conference Hall of the University of Belgrade Faculty of Law, Bulevar kralja Aleksandra 67

The presentation examines how countries determine tax residency, focusing on both shared elements and notable differences in domestic rules, such as the weight of specific factors, presumptions, and legislative approaches. It further considers the identification of best practices and the potential for harmonisation within the European Union.

Prof. Dr. Jean-Philippe van West’s CV

Jean-Philippe Van West is Professor of International and European Tax Law at the Vrije Universiteit Brussel. His research focuses on tax treaty law, European tax integration, and the interaction between international tax law, EU law and domestic law. He has published widely in leading journals and contributes regularly to academic and policy discussions at the national and international level. An overview of his academic activities is available via this link:https://researchportal.vub.be/en/persons/jean-philippe-van-west