Tax autumn at the University of Belgrade Faculty of Law – Two lectures

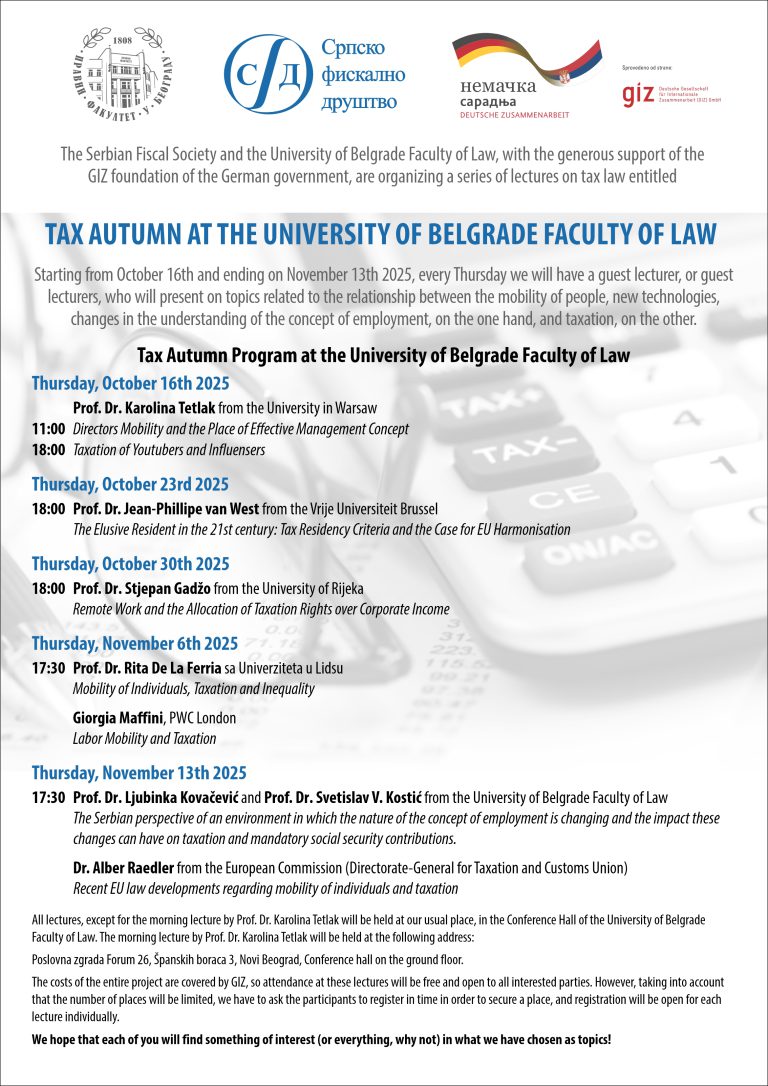

The Serbian Fiscal Society has the pleasure to invite you to the first two in a set of lectures which will be organized under our joint initiative with the University of Belgrade Faculty of Law and with the support of the Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH,

Tax autumn at the University of Belgrade Faculty of Law

On Thursday 16th October 2025 we will have the honor of hosting Prof. Dr. Karolina Tetlak from the University of Warsaw, who will give two lectures on the same day. Due to the generous support of the GIZ foundation attendance to the lectures is free of charge and they are open to all interested participants. The lectures will be in English.

Prof. Dr. Tetlak’s first lecture will be given on the topic of:

DIRECTORS’ MOBILITY AND THE PLACE OF EFFECTIVE MANAGEMENT

The mobility of directors and the rise of remote work are reshaping one of the most critical concepts in international taxation: the place of effective management (POEM). For decades, POEM served as the key tie-breaker rule to resolve conflicts of dual corporate residence under tax treaties. Since the 2017 OECD Model update, however, this role has been replaced by the mutual agreement procedure (MAP), shifting the resolution of residence conflicts from a single substantive test to negotiation between tax authorities. At the same time, the digitalization of decision-making has made POEM determinations more complex in practice. This lecture explores how directors’ mobility can trigger residence dtisputes, lead to the creation of permanent establishments, and even result in exit taxation if a company’s effective management is deemed to have shifted abroad. Drawing on recent academic research and international practice, it highlights practical strategies for directors and companies to mitigate risks, ensure legal certainty, and adapt to the realities of global mobility and digital management.

This lecture will begin at 11:00 and will be held at the following address:

Poslovna zgrada Forum 26, Španskih boraca 3, Novi Beograd, Conference Hall. The lecture will be followed by a discussion with the audience.

Due to a limited number of available seats please register for the lecture by sending a confirmation to office@sfd-ifa.rs. Places will be allocated on a first come, first served basis.

Prof. Dr. Tetlak’s second lecture will be given on the topic of:

TAXATION OF YOUTUBERS AND INFLUENCERS IN INTERNATIONAL TAX LAW

Youtubers, streamers, and social media influencers earn their living in ways that traditional tax systems were never designed to handle: ad revenue from YouTube, sponsored posts on Instagram, Twitch streaming subscriptions, brand collaborations, and even product placement in videos. This lecture looks at how international tax law tries to keep pace with these new business models. We will discuss how creators are classified for tax purposes, what happens when a digital nomad influencer has no clear country of residence, and how cross-border income is allocated under double tax treaties. Special attention will be given to the treaty provisions most relevant for this sector—Articles 7, 14, and 17 of the OECD Model—and to the practical challenges of withholding tax when payments flow through global platforms like Google or Meta. Real-world examples will show how a Serbian YouTuber working with a Polish or German brand, or a lifestyle influencer based in Dubai, might be taxed differently depending on the structure of their deals. Finally, we will consider how tax authorities are responding to new sources of revenue such as NFTs, metaverse appearances, and virtual sponsorships, and why enforcing tax rules in the creator economy is becoming one of the toughest challenges for governments worldwide.

This lecture will be begin at 18:00 and will be held at the Conference Hall of the University of Belgrade Faculty of Law. The lecture will be followed by a discussion with the audience

Due to a limited number of available seats please register for the lecture by sending a confirmation to office@sfd-ifa.rs. Places will be allocated on a first come, first served basis.

Prof. Dr. Karolina Tetlak’s CV

Dr. Karolina Tetłak, LL.M. is an assistant professor of tax law at the University of Warsaw (Poland), with over 20 years of academic and advisory experience. Her research focuses on Polish, European, and international taxation, particularly double tax treaties, legal interpretation, and tax policy. She has published extensively on income tax, corporate taxation, and VAT, and is also an expert in real estate taxation, property taxes, and the strategic use of local fiscal instruments. Her academic interests extend to public finance, including green taxation and the financing of the European Union through own resources.

Dr. Tetłak is widely recognized for her expertise in the taxation of highly mobile individuals, including athletes, entertainers, digital nomads, and cross-border workers and executives. She is considered a leading authority in sports taxation, with a unique specialization in the fiscal framework of major international sporting events such as the FIFA World Cup, Olympic Games, and UEFA tournaments. She has advised on host city contracts, government guarantees, and special tax regimes for international events, bridging academic research with practical implementation. She has also served as an expert witness in tax-related arbitration proceedings before the Court of Arbitration for Sport (CAS) and the International Centre for Settlement of Investment Disputes (ICSID).

In her advisory work, Dr. Tetłak supports private clients—particularly those engaged in cross-border investments, venture capital, and real estate structures. She advises on the tax implications of asset holding and investment vehicles, including venture capital structures, real estate portfolios, and family foundations. Her practice includes the design of tax-compliant solutions for restructuring and M&A transactions, and she also advises governments and tax administrations on tax design, treaty application, and the alignment of domestic tax systems with EU and treaty law. Her recent work includes contributions to United Nations projects, tax reform initiatives in the Middle East, and national reports for the European Commission.

Dr. Tetłak holds a Ph.D. in law and an LL.M. in Taxation from Harvard Law School. She teaches international tax law at universities worldwide and is a frequent speaker at global tax conferences.